38 christmas bonus gift card taxable

Bonus Tax Rate 2022: How Are Bonuses Taxed and Who Pays? If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets taxed at 37%. Your employer must use the percentage method if the bonus is ... Bonuses, Gifts & Fringe Benefits: Taxable and Deductible - Simple Profit Because there is no mechanism to tax the recipient of these gifts, as no income is reported on a W2 or 1099-Misc, the business deduction is limited to $25 per person. Therefore, if you give a holiday gift basket that cost $125 you can only deduct $25. Direct and indirect gifts The limit of $25 includes direct and indirect gifts.

Is there a taxable benefit? - Canada.ca Is there a taxable benefit? Question 3 Is the gift or award any of the following? Cash or near-cash gifts and awards, such as Christmas or holiday bonuses or gift certificates/cards. Performance-related rewards, such as meeting or exceeding sales targets, or the completion of a project.

Christmas bonus gift card taxable

Gifts, awards, and long-service awards - Canada.ca Calculation for your taxable amount The gifts and awards that fall within the policy are the award in recognition, the birthday gift, and the holiday gift that have a total value of $375 + $175 + $50 = $600. Therefore, your taxable benefit under the policy is $100 ($600 − $500). Tax Consequences of Volunteer and Staff Gifts A nonprofit gives each volunteer that worked so hard on their annual fundraiser a $25 gift certificate to the same restaurant the church took their employees to. According to the IRS, the gift certificate would be taxable income to each volunteer. See more on even more serious tax consequences on giving cash or gift cards to volunteers below ... Christmas Bonus vs. Year-End Bonus, Is there a taxable difference? According to the IRS, bonuses of money and of gift cards (considered a monetary equivalent) are considered taxable income and must be reported. They should be included on your W-2. If your employer has neglected to account for them - you can ask for a corrected W-2 before you file your taxes.

Christmas bonus gift card taxable. :: Christmas bonus, if done right, offers chance to reward employees ... At his 30 per cent tax rate, the pre-tax income Wong needed to have $150 of cash left over after tax was $214.29. So when all is said and done, Wong gave up $714.29 ($500.00 plus $214.29) of his income to buy the same thing Wright bought for $500. By opting to take his bonus in the form of cash instead of a gift, Wong did the wrong thing. Expenses and benefits: Christmas bonuses: Overview - GOV.UK Technical guidance Overview As an employer providing Christmas bonuses to your employees, you have certain tax, National Insurance and reporting obligations. This depends on: whether you give cash... My employer gave me a $100 Walmart gift card as a Christmas bonus, how ... Your employer is required to include the gift in your W-2 box 1 taxable income and to withhold social security and Medicare tax. If your employer does not report this, there is a way to report this as "other income that should have been on my W-2". That way you only pay 7.65% social security and Medicare tax instead of 15.3% self employment tax. Tax Implications of Employee Christmas Bonuses and Gifts Now that the Christmas season has arrived, one issue that many employers have is how to give those sought after yearend bonuses to their employees. No matter what type of Christmas bonus you give to your employee, there are tax consequences to either your company or to your employee. We will discuss some of these

What Employers Need To Know About Holiday Gifts & Bonuses For any monetary bonus, the bonus amount must be reported as taxable income on an employee's W-2 form. Additionally, non-discretionary bonuses are included when calculating regular rate of pay for overtime. If you provide a holiday gift in the form of cash or a cash equivalent, the gift is taxable - regardless of the amount. Taxation and Deductibility of Christmas Bonuses and Gifts Gifts to employees are limited to a $25 tax deduction no matter the value of the gift. If you are married, you and your spouse are treated as one taxpayer for the $25 deduction; if you both own separate companies and each give the same person a gift, you many only deduct $25 - not $50. Are you giving holiday bonuses or gift cards? Here's how to stay ... - BLR Gift certificates that can be used like cash do not fall under the de minimis exception. If the employer gives its employees a $25 gift card to the same store, but not specifically for a turkey or ham, the gift card is taxable as income. So be generous this holiday season, but know the rules! Holiday and Employee Bonuses Resources: Tackling the Holiday Bonus Question: A Guide for Employers Smaller, non-monetary holiday gifts worth less than $100 (such as a holiday basket or a personalized gift with the company logo) are typically considered a de minimis fringe benefit and are not taxable. However, according to IRS guidance, gift cards or gift certificates are taxable.

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Accordingly, a gift card or gift certificate that can only be redeemed for a specific, tangible item (for example, a ham, movie pass, or box of chocolates) may qualify as a de minimis fringe ... Tax Rules of Employee Gifts and Company Parties - FindLaw Taxable gifts: Gift certificates (cash in kind) are wages subject to taxes -- even for a de minimis item. For example, a gift certificate for a turkey is taxable, even though the gift of a turkey is not. Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt. Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software To give your employees a gift card with a value of $100 after taxes, record it as $142.15 gross and withhold $42.15 for taxes. Accounting for gift cards given to employees When you give gift cards to employees, include the value in the employee's wages on Form W-2. My Christmas Gifts Are Taxable Income? - TheStreet According to San Diego tax attorney Dean Sage, however, the IRS doesn't tax gifts up to the annual limit, $14,000 for 2013. So the value of holiday presents freely given, and worth less than a...

A Mini-Guide for Handling Holiday Bonuses and Gifts - Spark For federal tax purposes, bonuses up to $1 million are taxed at a flat rate of 25 percent. Many types of bonuses — such as gift cards and gift certificates — are considered taxable by the IRS if they can be easily exchanged for cash. However, holiday turkeys or other items of nominal value are generally not considered income.

What's The Best Tax-Free Gift Employers Can Offer Employees ... - Forbes In that way, it's like a double bonus. If you give a salaried employee time off, the same tax consequences apply as if the employee had worked a "regular" schedule, assuming that it's treated as ...

How to Handle Holiday Gifts to Employees | Basic Payroll - Patriot Software A holiday bonus check is typically a lump sum that you add to an employee's wages. Bonuses are taxable wages. One of the payroll basics you need to remember is to withhold payroll taxes from employee wages. These include income taxes and FICA taxes. You also have to pay unemployment taxes and the employer part of FICA taxes. Holiday gifts

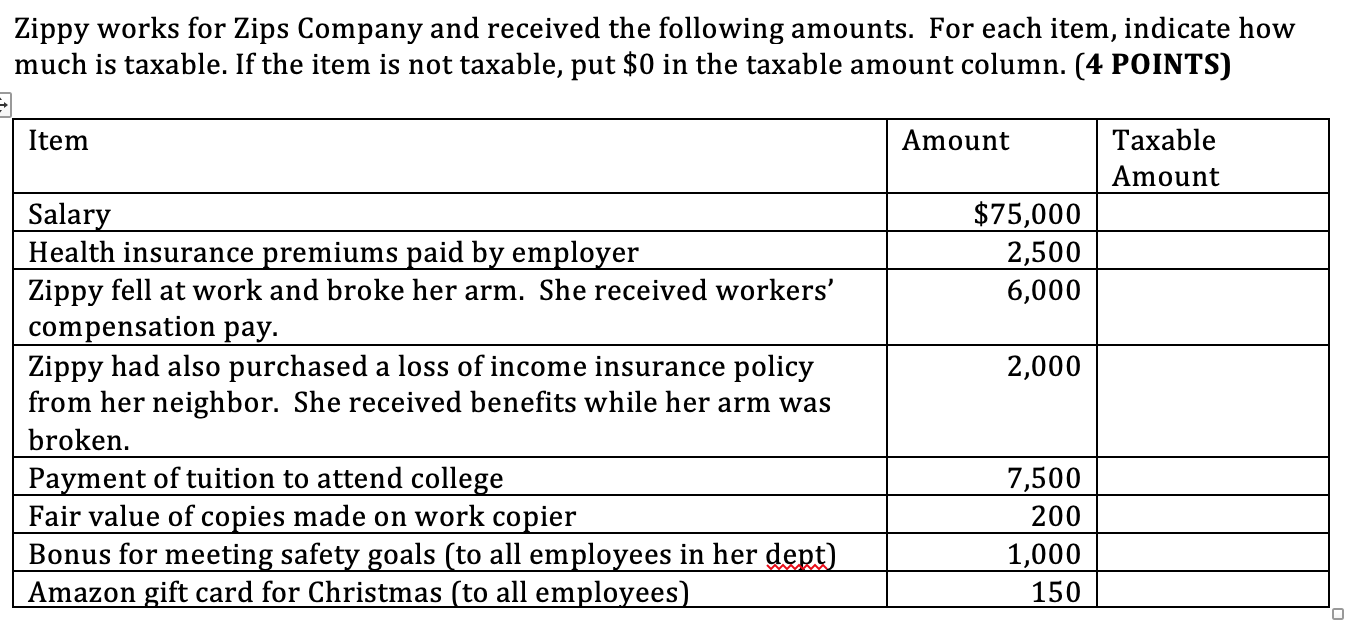

Employee Awards and Gifts: What is Taxable vs. Non-taxable? Safety awards are excluded from federal taxable wages if also given to management, administrative, professional, clerical, and part-time employees, but not to more than 10% of eligible employees during the tax year. If greater than 10% of eligible employees receive the award, all employee safety awards are taxable. Non-cash gifts

Bonus Tax Rate | H&R Block If the bonus is paid or identified separately, it can be taxed at a flat rate of 22%. Either way, the paying of the supplemental wages will affect your tax withholding for that period, so be prepared. Tax on a Bonus Exceeding $1 Million Any excess wages over $1 million will be taxed at a rate of 37%. Tax Reporting of Bonuses - Where Do You Start?

Gifts for employees and clients: Tax FAQs answered - MYOB Pulse Non-entertainment gifts that cost less than $300 are fully tax deductible with no FBT payable. Non-entertainment gifts given to staff (including working directors) are usually exempt from FBT where the total cost is less than $300 inclusive of GST per staff member. A tax deduction and GST credit can also be claimed.

The Tax Implications of Receiving a Holiday Bonus Energy-efficient home improvements will provide you with a tax credit of up to $1,500 or 30% of the cost of the improvements. Qualifying improvements include things like adding insulation, replacing windows, and adding energy-efficient doors. Give it Away - If you were fortunate enough to get a bonus this year, you may desire to share some of ...

Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year.

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount.

How to give workers a tax free gift in four simple steps Order it. For One4all Gift Cards, this is as simple as selecting a value, quantity and entering your payment and delivery details. Gift cards are delivered within 3-5 days, with free standard delivery available on all orders and free signed for delivery on orders of over £500 in value, and pre-Christmas orders can be placed up to 21st December ...

Christmas Bonus vs. Year-End Bonus, Is there a taxable difference? According to the IRS, bonuses of money and of gift cards (considered a monetary equivalent) are considered taxable income and must be reported. They should be included on your W-2. If your employer has neglected to account for them - you can ask for a corrected W-2 before you file your taxes.

Tax Consequences of Volunteer and Staff Gifts A nonprofit gives each volunteer that worked so hard on their annual fundraiser a $25 gift certificate to the same restaurant the church took their employees to. According to the IRS, the gift certificate would be taxable income to each volunteer. See more on even more serious tax consequences on giving cash or gift cards to volunteers below ...

Gifts, awards, and long-service awards - Canada.ca Calculation for your taxable amount The gifts and awards that fall within the policy are the award in recognition, the birthday gift, and the holiday gift that have a total value of $375 + $175 + $50 = $600. Therefore, your taxable benefit under the policy is $100 ($600 − $500).

/businessman-opening-gifts-at-birthday-lunch-591405997-57a61e5f5f9b58974a206502.jpg)

0 Response to "38 christmas bonus gift card taxable"

Post a Comment