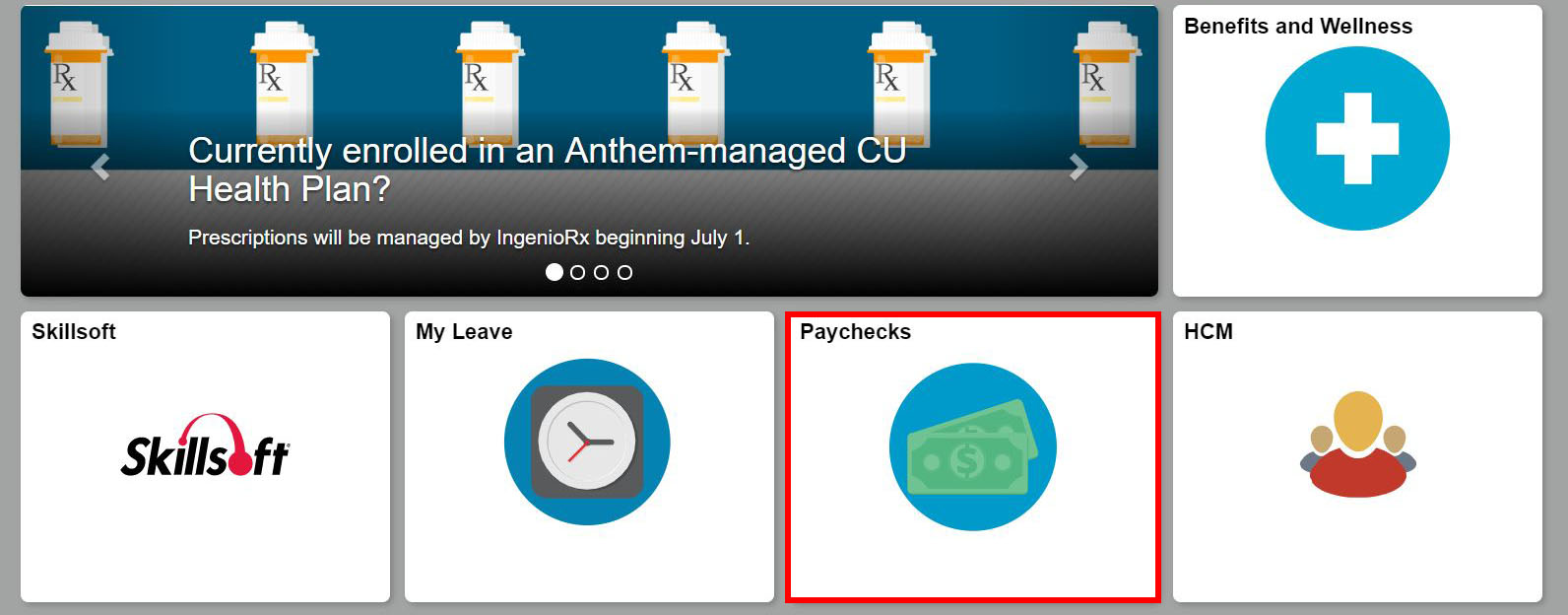

44 gift card for employee taxable

Are Employee Gift Cards Considered Taxable Benefits? According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages. Are Employee Gifts Taxable? Everything You Need To Know ... Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

GST and FBT - Giving vouchers to staff - TaxEd Based on the above, a gift card can be a voucher. The default position is that a supply of a voucher will be a taxable supply where the requirements of section 9-5 are met. However, where the conditions in Division 100 apply the supply of the voucher is generally not treated as a taxable supply.

Gift card for employee taxable

Canadian Income Tax Rules for Employee Gifts The general rule is that all gifts given to employees are considered to be taxable benefits by the CRA except for the following exemptions: Employees may receive up to $500 in fair market value of noncash gifts in a year. Employees may receive noncash gifts in recognition of long service valued at less than $500 once every five years. Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year. Are Gift Cards For Employees Considered Tax-deductible ... • Employees need to report gift cards and gift certificates as taxable income since these are used in the same way as money. While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives.

Gift card for employee taxable. Are Gift Cards Taxable? | Workest Employee earns $15 per hour, 40 hours per week: base wages $600. 25% tax rate ($125) take-home pay is $450. If the employer offers a $100 gift card, base wages increase to $700 per week 25% tax rate ($175) take-home pay is $425 (plus the $100 gift card). An additional $25 on the gift card offsets the paycheck cash loss. What are the tax implications of employee gift cards ... Employers planning on giving gift cards should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income. Although there may be limited situations when the value of a gift card or gift certificate could be excluded from an employee's income, employers might want to take a ... Are Gifts to Employees Taxable? — SST Accountants ... But if the employer gave a gift card to a grocery store for the employee to purchase a turkey, the value of the gift card would be taxable because it is a cash equivalent. For more information, please refer to IRS Publication 5137, Fringe Benefit Guide, or contact the experts at SST for additional assistance. PDF New IRS Advice on Taxability of Gift Cards ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

Are Employee Gifts Taxable?: A Complete Guide to the De ... General merchandise gift cards do not qualify and are taxable. The IRS would consider as little as a $5 gift card to a general retailer as employee income. Again, there is one exception: a gift certificate that an employee can exchange for a specific, tangible item. Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable ... Employers planning on giving gift cards this season should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income. Understanding the Taxability of Employee Non-Cash Awards ... The Federal Tax Cuts and Jobs Act (P.L. 115-97) signed into law on December 22, 2017 changed the taxability of some non-cash awards and other gifts provided to employees. If an award or gift (or portion of an award or gift) is taxable, applicable income tax withholding and FICA taxes will be deducted from the employee's paycheck.. Beginning on April 1, 2018, departments are responsible for ... › legal-encyclopedia › employee-fringeEmployee Fringe Benefits That are Tax Free | Nolo However, benefits received under the insurance may be partly taxable if they exceed limits set by the IRS. Group term life insurance. A company may provide up to $50,000 in group term life insurance to each employee tax free. If an employee is given more than $50,000 in coverage, the employee must pay tax on the excess amount.

Expenses and benefits: gifts to employees - GOV.UK As an employer providing gifts to your employees, you have certain tax, National Insurance and reporting obligations. Businesses There are different rules depending on the type of gift you give.... Is gift card taxable to employee if employer is a non ... Is gift card taxable to employee if presented by employer as prize to select employees for winning a contest; is gift card taxable to employee if employer is a non-profit and gift card is for non-profit's retail stores of donated merchandise? 0 3 1,978 Reply. 3 Replies Hal_Al. Level 15 May 31, 2019 11:14 AM. › government-entities › federal-stateDe Minimis Fringe Benefits | Internal Revenue Service Mar 29, 2022 · Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. A certificate that allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for, may be excludable as ... Are Employee Gift Cards Taxable? - Stratus.hr® Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. Bottom line: no matter the amount, a gift card given to employees is not considered a de minimis fringe benefit. Instead, it should be included in wages on Form W-2 and subject to tax withholdings.

Do gift cards count as taxable income? The gift cards are taxable compensation to the employees. If the employer pays the employees' portion of the taxes, that payment also represents income to the employees and is taxable to the...

› gift-taxGift Tax | Internal Revenue Service Feb 04, 2022 · The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return.

Write Off Gift Cards Given To Employees? | Blackhawk Network A gift card (also known as a gift certificate) is a form of stipend. Employees may receive fringe benefits on top of their normal pay. Depending on the nature of the fringe benefit, it could be taxable or nontaxable. Federal taxes apply to taxable fringe benefits like income, Social Security Benefits, Medicare and Federal Unemployment insurance.

Ask the Expert: Are All Gift Cards Taxable Income? However, section (c) (1) of this law provides that employee gifts (including prizes and awards) - specifically "any amount transferred by or for an employer to, or for the benefit of, an employee" - may not be excluded from gross income. So the general rule is that employee gifts and prizes are counted as income.

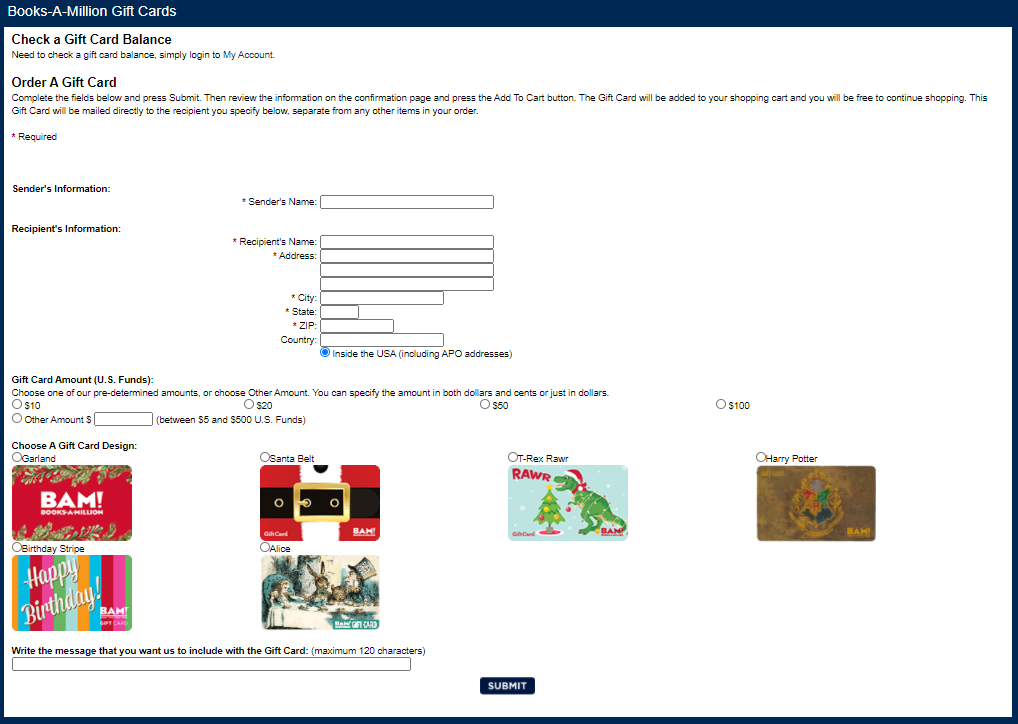

› gift-cards-for-small-busiSmall Business Gift Cards Guide & Best Digital Gift Card Systems May 10, 2022 · Whatever gift card program you use with Stripe may charge its own fees, however. Hardware Cost. N/A. Payment Processing. Stripe’s online payment processing has a flat rate of 2.9% + $0.30. The gift card software you use with Stripe may or may not charge an additional transaction fee on gift card purchases. Contract Requirements/Warnings

Solved: Are gift cards from rewards sites taxable as income? The way I understand this is that if these rewards are de minimis fringe benefits and are taxable then Swagbucks, MyPoints, etc, should be withholding taxes and providing a Form W-2, but they don't. They don't even provide a Form 1099-Misc. I'm not an employee of these websites.

How to Deduct Employee Gifts, Awards, and Bonuses Cash payments or cash equivalent cards you give to employees are considered to be wages and these are always taxable to the employee. Gift certificates that can be redeemed by the employee for retail products also aren't de minimis and they are taxable to the employee. 3 Bonuses to Owners and Employees

Can I give my employee a gift card without being taxed ... There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount. No matter the amount, a gift card given to employees is not considered a de minimis fringe benefit.

Giving Gifts to Employees: Best Practices You can give gift cards to your employees as presents, but your employees must then list the amount of the gift card as income on their annual taxes. Any cash or cash equivalent given by an employer to an employee is considered income by the IRS and must be taxed that way.

› employer-guide-to-taxableEmployer Guide: What Employee Compensation Is Taxable? Feb 28, 2020 · You may have heard that if you give a gift card under $25 to an employee it's not taxable. That's not true. The IRS says that cash and cash equivalents (gift cards or gift certificates or the use of a charge card, for example) no matter how small, are never considered de minimis, and these payments are taxable to the employee.

› blog › payrollAre Gift Cards Taxable? | Taxation, Examples, & More Dec 11, 2020 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00

Gifts, awards, and long-service awards - Canada.ca If the FMV of the gifts and awards you give your employee is greater than $500, the amount over $500 must be included in the employee's income. For example, if you give gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). There are special rules for Long-service awards.

› guidance › employee-incentive-awardsEmployee incentive awards - GOV.UK Jun 12, 2014 · Overview. If you give out incentive awards as part of a pay package, or your employees get awards from a third party, you may need to pay PAYE tax and National Insurance contributions (NICs) on ...

Tax Rules of Employee Gifts and Company Parties - FindLaw Taxable gifts: Gift certificates (cash in kind) are wages subject to taxes -- even for a de minimis item. For example, a gift certificate for a turkey is taxable, even though the gift of a turkey is not. Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt.

Can Not-for-profits Use Gift Cards? | Tax Considerations Tax Considerations of Gift Cards Since gift cards, even for a specific purpose such as to a restaurant or grocery store, are treated as cash, when given to an employee or volunteer, must be recorded as wages. Wages mean that appropriate taxes must be taken out and the entire amount reported on the individual's W-2.

Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

0 Response to "44 gift card for employee taxable"

Post a Comment